long term care insurance washington state tax opt out

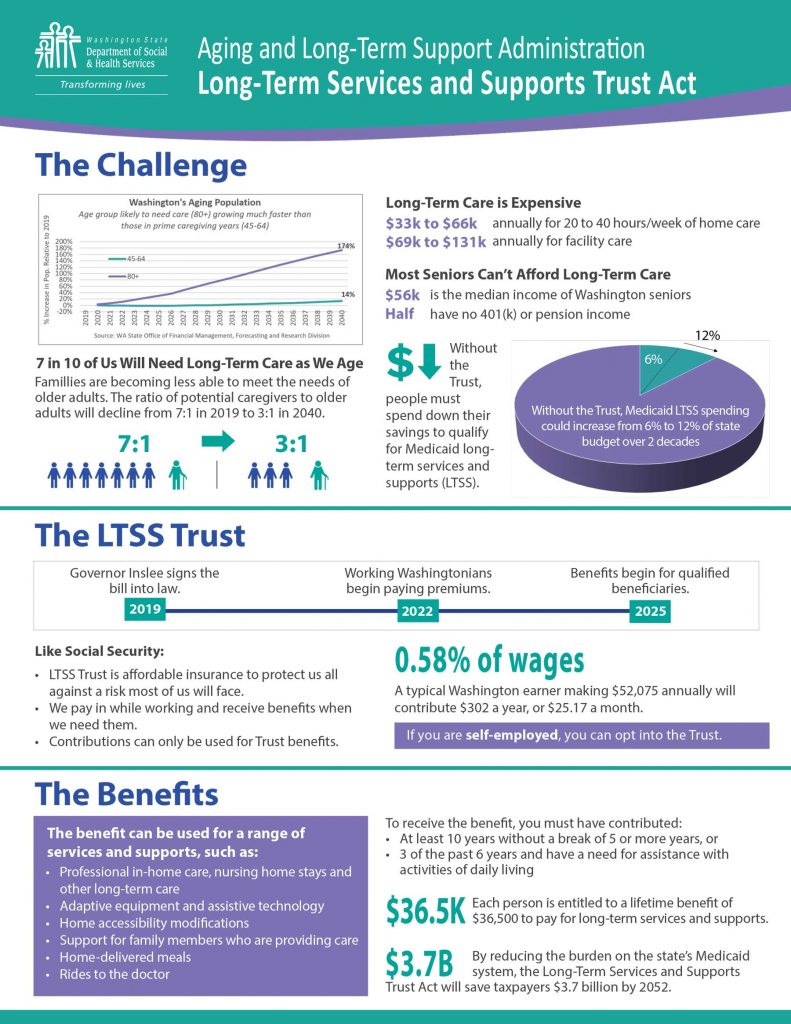

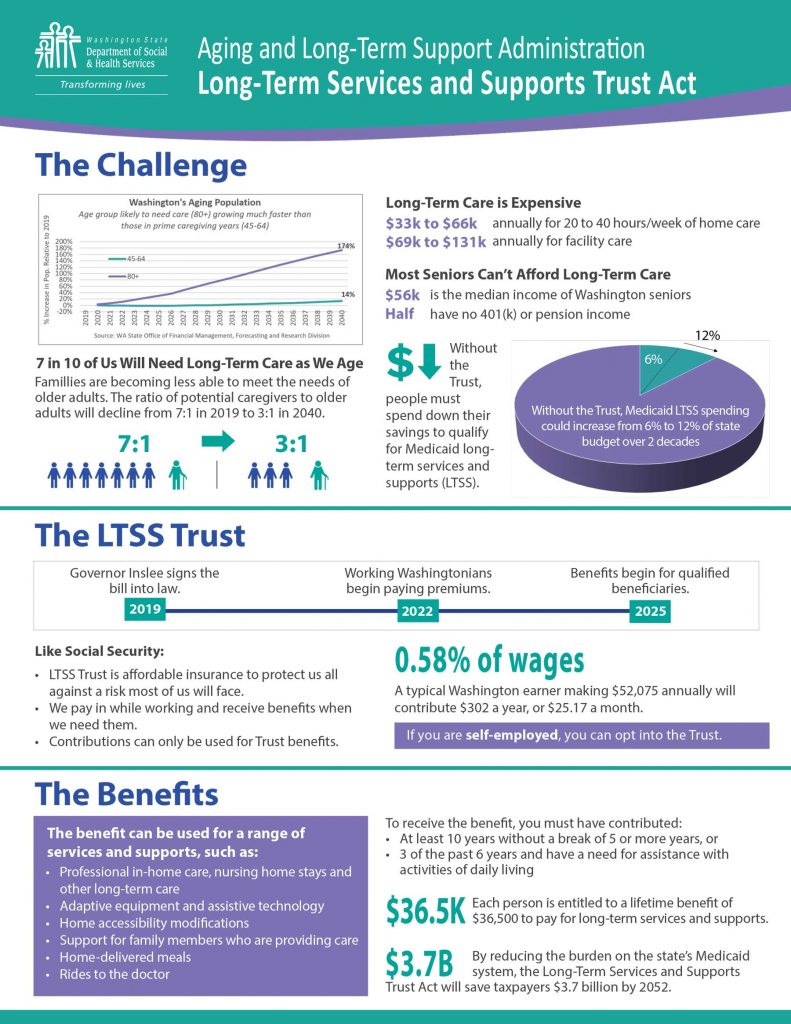

Originally signed in 2019 by Governor Jay Inslee as of January 1st 2025 Washington State Residents who need long-term care may be able to claim benefits based on needing help with 3 of 10 ADLs from the state and receive a benefit of up to 100 per day up to a maximum benefit of 36500. Certain workers who would be unlikely to qualify or use their benefits can request an exemption.

Long Term Care Insurance Washington State S New Law White Coat Investor

You must also currently reside in the State of Washington when you need care.

. In that case the tax will be permanent and mandatory. The only exception is to opt out by purchasing private long-term care insurance. Washington State Long-Term Care Tax Opt-Out.

In 2020 the legislature approved a one-time opportunity to allow people with private long-term care coverage to apply for exemptions. Time has run out. The long-term care program was passed by the legislature and signed into law by the governor in 2019.

Undoubtedly for many families these benefits are. Washington residents have one chance to get out of the public long-term care program. Long-term care insurance companies have temporarily halted sales in Washington.

Back in 2019 the state passed a law to fund a public long-term care program through a mandatory payroll tax on every W-2 employee. This is also true if you move to Washington state after the opt out window closes after 12312022 and you didnt already own long-term care insurance with a policy date before 1112021. Health care cost trends.

The insurance companies will be re-entering the market after November 1. If you buy long-term care insurance before November 1 2021 you can get an exemption from. Individuals who have private long-term care insurance may opt-out.

Find information about long-term care filing requirements actuarial memo requirements and partnership program requirements. If you have children in highschool or college who will be entering the workforce after the 1231. Exemptions for these workers will only remain valid if the exemption criteria are met eg if.

An employee tax for Washingtons new long-term care benefits starts in January. 2062817211 phone 2062836122 fax. Beginning January 1 st 2022 Washington residents will fund the program via a payroll tax.

Workers who wish to apply for an exemption because they hold a long-term care insurance plan purchased by Nov. Keep in mind that. If you buy private long-term care insurance before November 1 2021 and your private insurance is qualified you can get out of the public program.

26 2021 inviting passersby to come in and ask questions about Washingtons long-term care tax. WHAT IS THE TAX. There is no indication that the opt-out period will be extended.

Under current law you have one opportunity to opt out of this tax by having a long-term care insurance LTCi policy in place by November 1 st 2021. This tax is permanent and applies to all residents even if your employer is located. You have one opportunity to opt out of the program by having a long-term care insurance policy in place by November 1 st 2021.

On April 14 2021 the House passed an amendment to the original Bill SHB 1323 extending the deadline from July 24 2021 to November 1 2021. Near-retirees earn partial benefits for each year they work. The window to apply for an exemption occurs between October 1 st 2021 and December 31 st 2022.

Things were relatively quiet until the state amended the law in April 2021to shorten the time available to purchase private LTCi. The employee must provide proof of their ESD exemption to their employer before the employer. But if you want to opt out you may have some trouble.

1 2021 must still apply by Dec. After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care program. Learn more about Washington State long-term care trust act tax exemptions and coverage.

Criminal Investigations Unit CIU Current issues. Update April 16 2021. Washingtons new long-term care insurance tax charges.

The deadline to have a long term care policy in place was November 1 2021. An employee has a one-time opportunity to opt-out if they have comparable private long-term care insurance. This money will cover services and support some retirees need to.

There is a new Washington State long-term care tax. It is too late. This means that if you purchased a private long-term care policy that you should not cancel it.

Report insurance fraud in Washington state. If you want a long term care plan to supplement the state run plan. These are workers who live out of state military spouses workers on non-immigrant visas and.

So as an example if you currently earn 100000 of W2 income you will be paying. As of January 2022 WA Cares Fund has a new timeline and improved coverage. The tax is set at 058 and will automatically come out of your paycheck at an amount of 58 cents for every 100 of W2 income you earn and is subject to change beginning in 2024 and every two years thereafter.

If you meet the opt-out criteria and purchased your LTC policy prior to Nov 1 2021 you have until December 31 2022 to opt-out of. A sandwich board sits outside an insurance brokers office in Seattles Fremont neighborhood on Aug. It is too late to Buy LTC insurance to avoid the Washington Long Term Care Tax.

You needed to apply earlier to have coverage in place by November 1 2021. The Washington Cares Fund collects 58 cents for every 100 of income that workers in the state earn until they retire. The Window to Opt-Out.

File amend and view premium taxes. Washington State Hospital Association 999 Third Avenue Suite 1400 Seattle WA 98104. New State Employee Payroll Tax Law for Long-Term Care Benefits.

The tax has not been repealed it has been delayed. Employees now have until November 1 2021 to purchase long-term care insurance if they wish to opt out of the Washington State Long-Term Care Program. An employee who attests they purchased long-term care insurance before November 1 2021 may apply for an exemption from the premium assessment.

The move follows a frenzy of interest in the costly insurance policies prompted by a November 1 deadline to opt out.

Wa Cares Exemption How To Opt Out Of The Tax Brighton Jones

Time Expiring For Washington Residents In 30s And 40s To Avoid New Tax American Association For Long Term Care Insurance

What Happened To Washington S Long Term Care Tax Seattle Met

How Do You Opt Out Of Washington State S Long Term Care Tax Youtube

What You Need To Know About Washington S New Long Term Care Benefit And The Tax That Comes With It

Ltca Long Term Care Trust Act Worth The Cost

Long Term Care Insurance Washington State S New Law White Coat Investor

Kuow Want To Opt Out Of Washington S New Long Term Care Tax Good Luck Getting A Private Policy In Time

Washington State Long Term Care Program Tax Premium Should I Get A Personal Ltc Policy To Opt Out 27yo May Not Get Another Change To Opt Out R Personalfinance

Washington State Trust Act Should You Opt Out Buddyins

.jpg?width=565&name=WA%20Trust%20Act%20Tax%20(based%20on%20salary).jpg)

The Private Ltc Insurance Option For Washington State Workers

Why Some Plan To Opt Out Of New Wa Long Term Care Insurance R Seattle

Lawsuit Seeks To Overturn Washington State S Public Long Term Care Insurance Program

Washington State Long Term Care Tax Here S How To Opt Out

Washington State S New Long Term Care Payroll Tax Won T Kick In Until Next Year Benefits In 2026 Oregonlive Com

Washington State Long Term Care Tax What You Need To Know North Town Insurance

Analyst S Advice For Washingtonians Who Got Private Long Term Care Insurance Mynorthwest Com

Long Term Care Insurers Return To Washington Market After State Delays Program Spokane Journal Of Business

Kuow Washington House Votes To Delay Long Term Care Tax For 18 Months